Is BitCoin still private after the EU’s AMLD5?

The fifth EU Anti-Money Laundering Directive (AMLD5) has my interest. Not because it creates stricter rules for the traditional financial sector, but because it specifically addresses the virtual currencies industry. Yes, what most of us know as “crypto”, that are virtual currencies.

Although the AMLD5 already entered into force on the 9th of July, 2018, an EU directive is not a law by itself. The directive is an obligation for EU member states to establish national laws in line with the directive, and they must do so before the 20th of January, 2020. This directive aims, as its title suggests, to prevent money laundering and the financing of terrorism. It identifies the risk that anonymous virtual currency transactions can enable money laundering and funding of terrorism.

The virtual currencies industry

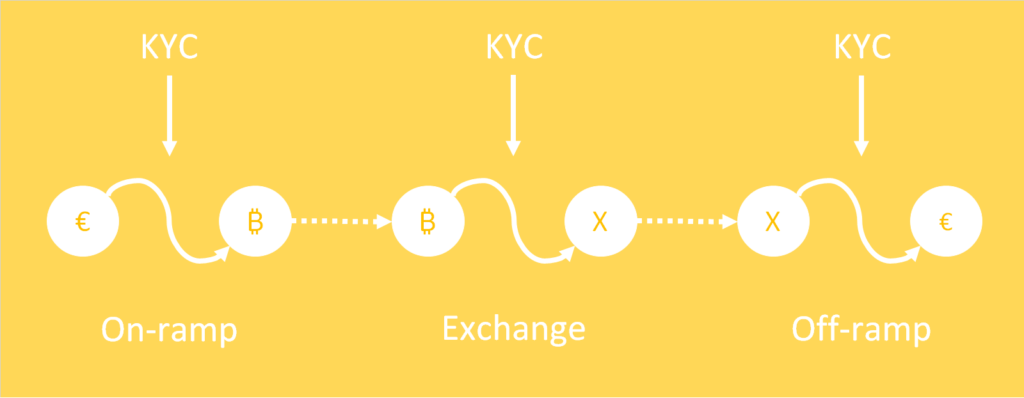

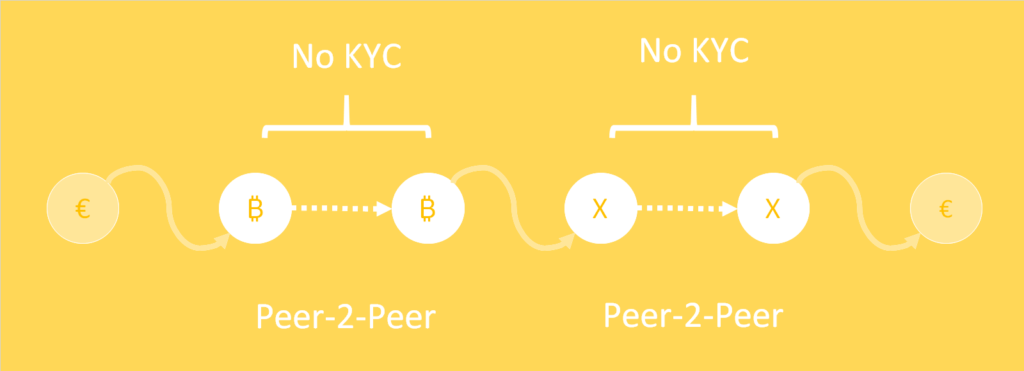

If you read through this directive, you’ll notice that it requires to Know Your Customer (KYC) procedures for two specific types of services in regard to the virtual currency industry. Those are on-ramps and off-ramps from fiat currencies to virtual currencies and custodian wallet providers.

“custodian wallet provider” means an entity that provides services to safeguard private cryptographic keys on behalf of its customers, to hold, store and transfer virtual currencies.

Keep in mind that cryptocurrency exchanges are also custodian wallet providers as they have control over virtual currencies deposited to them in order to execute trades on their platform on customers’ behalf.

This directive, therefore, provides Financial Intelligence Units (FIUs) insight into identities associated with transactions from fiat currencies to virtual currencies (such as BitCoin), virtual currencies to virtual currencies and virtual currencies to fiat currencies.

The impact of this directive on the virtual currencies industry is that any services active in this sector have to comply with the same laws and regulations apply as is already customary in the traditional financial sector.

Users

Although non-custodial software wallets have no requirements for KYC, if needed, Financial Intelligence Units (FIUs) can link identities to wallets whenever such a wallet is used to receive funds from fiat on-ramps and off-ramps or an exchange that does need to comply with KYC requirements. So if you have acquired any virtual currencies to purchase illegal goods or services, know that you are not anonymous.

This doesn’t mean there is no such thing as privacy. According to AMLD5, it is allowed to make or receive cash payments up to €10,000. This is no different for transactions made or received with virtual currencies. EU member states can implement lower thresholds, so make sure you understand what the limit for cash transactions is in your country.

Yes, merchants must account for all transactions and pay their taxes, but just as with cash transactions in fiat, there is no need for any KYC. As a consumer, you can still use BitCoin for buying “censorship-resistant coffee” or any kinky stuff you like to keep private. As long as the merchant accepts your type of virtual currency as cash, you can use it as cash.

The impact of this directive on users is that we can use virtual currencies like BitCoin in the same manner as we use traditional fiat currencies. So yes, you can use it as cash.

Privacy

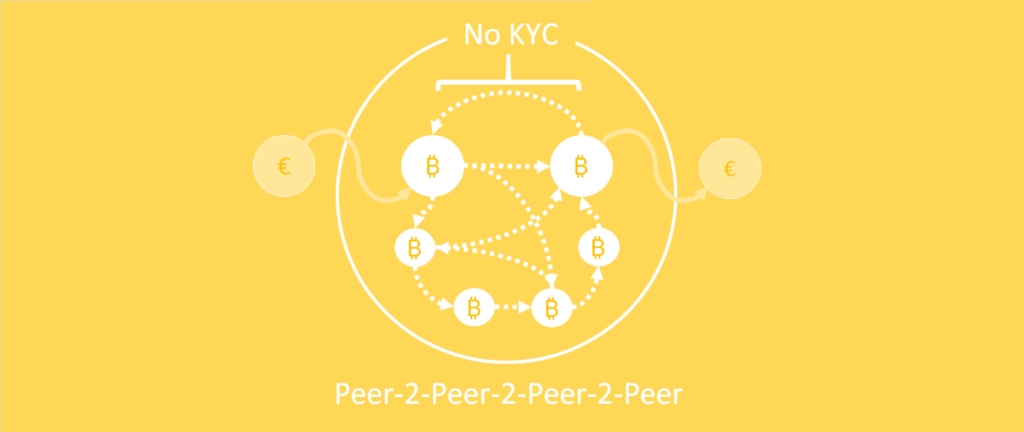

If you use BitCoin as cash in the intended configuration, peer-2-peer-2-peer-2-peer, and keep it circulating within the ecosystem, it can be just as private as if you were using fiat cash. And yes, it is also much more private than paying with debit or credit cards as your bank has insight and control over that kind of transaction history.

To me, this is a very appealing feature. Especially if we consider that other directive name, PSD2. This directive allows the emerging fintech industry to have fun with your personal transaction history.

We can conclude that BitCoin is still private after AMLD5, and you can use it as “cash.” Wasn’t this precisely how it was intended? What was the title of the BitCoin whitepaper again? Oh yes… “Bitcoin: a peer-2-peer digital cash system”. AMLD5 does makes it harder to use virtual currencies anonymously for money laundering and funding terrorism; but it does not remove privacy altogether. Yes, even after AMDL5, privacy is still a feature of BitCoin.