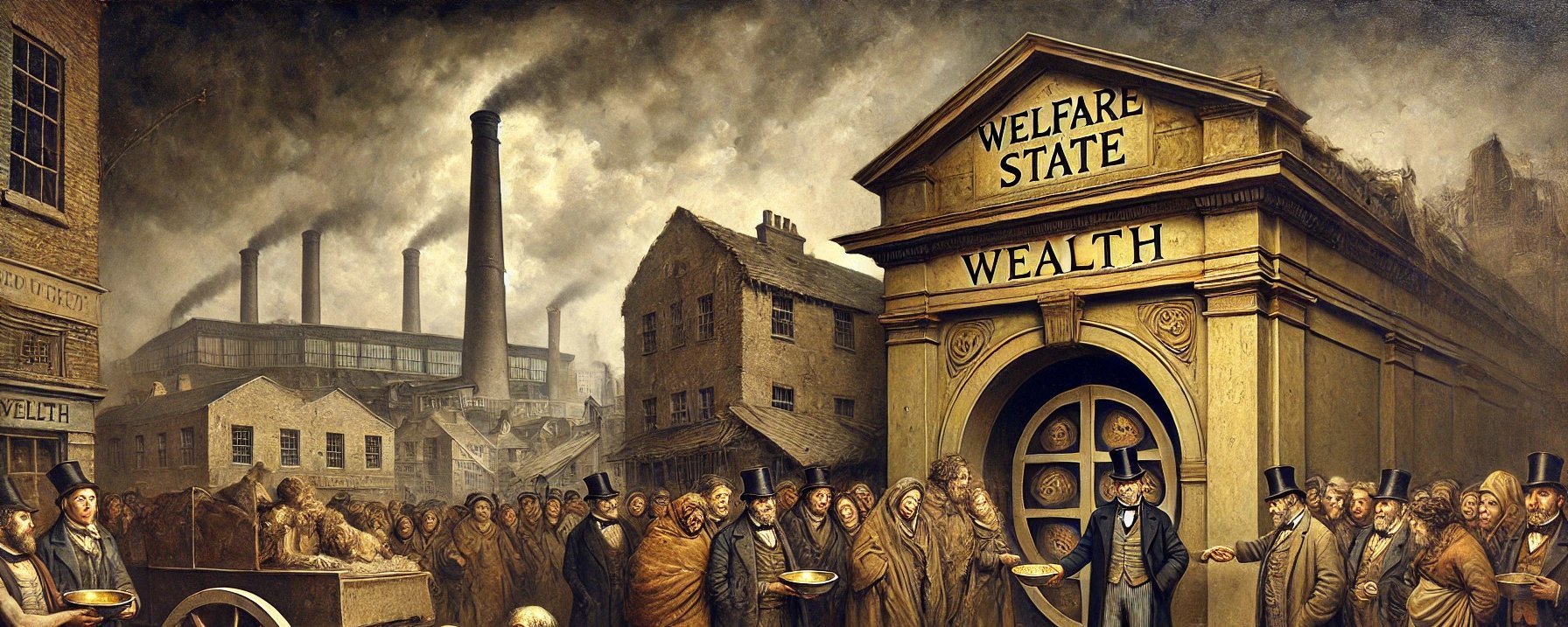

The Welfare State and the Infrastructure State… A Tale of Two Futures

Government intervention in the form of welfare programs often begins with good intentions: providing a safety net for the vulnerable, reducing poverty, and promoting equality. However, these programs are inherently flawed in their assumptions about human nature and economics. Over time, they create a class of dependents who become reliant on the state, rather than fostering a culture of productivity and self-reliance. Welfare policies shift the focus from wealth creation to wealth redistribution, and in doing so, they undermine the very foundations of long-term prosperity.

In contrast, a government that prioritises infrastructure investment lays the groundwork for sustained economic growth. By building roads, ports, energy grids, and digital networks, it creates the conditions for wealth generation, innovation, and opportunity. The difference between these two models (welfare versus infrastructure) is not just a matter of short-term relief versus long-term planning. It reflects a deeper philosophical divide: one that touches on the nature of human achievement, the role of the state, and the moral responsibility of individuals in society. This distinction is critical for understanding why welfare states stagnate, while infrastructure-focused states thrive.

The Dependency Trap: Welfare’s Long-Term Consequences

Welfare programs may seem compassionate on the surface, but their long-term consequences reveal a different story. When individuals come to rely on state aid for their livelihood, they lose the incentive to strive for self-reliance and personal growth. Welfare fosters a mindset of entitlement, where individuals expect the government to provide for their needs rather than seeking to earn their way through hard work, innovation, and creativity. Over time, this dependency erodes not only the economic productivity of a nation but also the dignity and initiative of its citizens.

Ayn Rand’s philosophy of objectivism offers an apt critique of the welfare state. According to Rand, human beings are rational and capable of achieving great things through their own efforts. The welfare state, however, denies this fundamental truth by encouraging individuals to live at the expense of others, rather than through their own productive work. Welfare, in Rand’s view, is not merely an economic misstep; it is a moral failing. It punishes the productive by forcing them to subsidize the non-productive, and it rewards the non-productive by allowing them to live without contributing to society. The result is a culture of mediocrity, where innovation and ambition are stifled by the burden of maintaining an ever-growing dependent class.

The problem with welfare goes deeper than simple economics; it affects the very fabric of society. Human beings are not meant to live as dependents; they are meant to create, to innovate, to achieve. Welfare programs rob individuals of their sense of purpose, trapping them in a cycle of dependency that becomes increasingly difficult to escape. This is not just a problem for the individuals who rely on welfare; it is a problem for society as a whole. As more and more people become dependent on the state, fewer resources are available for productive investment. Taxes must be raised to fund welfare programs, which in turn discourages economic growth and innovation. The welfare state becomes a vicious cycle of stagnation, where the productive are punished and the dependent are rewarded.

The Infrastructure Model: Building the Foundations for Growth

In contrast to the welfare state, a government that focuses on infrastructure creates the conditions for sustained economic growth. Infrastructure investment is not merely an expenditure; it is an investment in the future. Roads, bridges, ports, and energy grids are the arteries of economic activity. They reduce costs, increase efficiency, and open up new markets for trade and investment. Infrastructure doesn’t just redistribute wealth. It creates it.

Ayn Rand’s concept of rational self-interest aligns closely with the idea of infrastructure investment. According to Rand, individuals have the right to pursue their own happiness and success, and the role of government should be to protect those rights; not to provide for those who are unwilling to provide for themselves. Infrastructure investment does exactly that. It empowers individuals by creating the conditions in which they can succeed through their own efforts. It does not give them handouts; it gives them the tools to create wealth and improve their own lives.

The economic benefits of infrastructure investment compound over time. A road built today doesn’t just improve transportation efficiency in the short term: it generates wealth for decades to come. Each new infrastructure project creates new opportunities for businesses to grow, for jobs to be created, and for innovation to flourish. The benefits are not temporary; they are long-lasting and far-reaching.

Consider two countries that start with identical economies valued at £100 billion. One nation chooses the welfare model, with annual growth of 2%, while the other chooses the infrastructure model, growing at 4% annually. After 50 years, the welfare state’s economy has grown to £269 billion, while the infrastructure state’s economy has grown to £711 billion. What began as a small difference in growth rates has become a vast chasm between the two nations. The infrastructure state is more than twice as wealthy as the welfare state. This is the power of compound growth, small differences in policy decisions, when compounded over time, result in dramatically different outcomes.

The Moral Argument: Individual Responsibility vs. Collective Dependency

The difference between the welfare state and the infrastructure state is not just a matter of economics; it is also a matter of moral philosophy. The welfare state is built on the premise that individuals are entitled to live at the expense of others, that the productive members of society have a duty to support the non-productive. This is a fundamentally flawed view of human nature. Ayn Rand argues that human beings have the right to pursue their own happiness and that this right includes the freedom to reap the rewards of their own efforts. The welfare state, by forcing the productive to subsidize the non-productive, violates this principle.

The infrastructure state, by contrast, aligns with a moral philosophy that values individual responsibility and self-reliance. It does not seek to redistribute wealth; it seeks to create the conditions in which individuals can succeed through their own efforts. It rewards hard work, innovation, and creativity by providing the tools and the environment in which these qualities can flourish. The infrastructure state empowers individuals to achieve their full potential, rather than trapping them in a cycle of dependency.

Short-Term Relief vs. Long-Term Prosperity

One of the key differences between the welfare state and the infrastructure state is the trade-off between short-term relief and long-term prosperity. Welfare programs provide immediate relief to those in need, but they do so at the cost of long-term economic growth. By redistributing resources from the productive to the non-productive, welfare programs discourage innovation and investment, leading to slower economic growth over time.

Infrastructure investment, on the other hand, may not provide immediate relief, but it builds the foundation for long-term prosperity. A road built today may not immediately lift people out of poverty, but it will create opportunities for economic growth that will benefit future generations. Infrastructure investment is a long-term strategy that pays off over time, as the benefits of improved transportation, energy efficiency, and communication networks compound year after year.

This is the fundamental difference between the two models: welfare offers short-term relief, while infrastructure builds long-term prosperity. The welfare state is focused on maintaining the status quo, while the infrastructure state is focused on creating the conditions for future growth.

The Welfare State’s Long-Term Costs

While welfare programs may provide temporary relief, they come with significant long-term costs. As more people become dependent on the state, the government must raise taxes to fund these programs. This creates a disincentive for individuals to work and invest, as they know that a significant portion of their income will be taken by the state to support others. Over time, this leads to a shrinking productive sector and a growing dependent sector, as more and more people choose to rely on welfare rather than contributing to the economy.

The long-term costs of welfare are not just economic; they are also social. Welfare programs erode the work ethic, undermining the values of self-reliance, initiative, and personal responsibility. When individuals are taught to expect handouts from the state, they lose the incentive to strive for success. This creates a culture of entitlement, where individuals believe that they are owed a living by society, rather than understanding that they must earn it through their own efforts.

The Infrastructure State: A Legacy of Opportunity

In contrast to the welfare state’s legacy of dependency, the infrastructure state builds a legacy of opportunity. By investing in roads, bridges, ports, and energy grids, the government creates the conditions for economic growth, innovation, and prosperity. Each generation benefits from the infrastructure investments made by the previous generation, creating a virtuous cycle of growth and opportunity.

The infrastructure state does not seek to provide for people: it seeks to empower them. It does not hand out welfare checks; it builds the roads, ports, and energy grids that allow individuals to succeed on their own terms. It creates the conditions in which individuals can rise above their circumstances through hard work, innovation, and entrepreneurship. The infrastructure state rewards the productive members of society by providing them with the tools they need to succeed, rather than punishing them with high taxes to support those who do not contribute.

The False Compassion of the Welfare State

One of the most pervasive myths about the welfare state is that it is compassionate. The idea that the government should provide for those who cannot provide for themselves seems noble on the surface, but in reality, it is anything but. Welfare programs do not empower individuals; they degrade them. By encouraging dependency, welfare robs individuals of their sense of self-worth and purpose. It traps them in a cycle of mediocrity, where they are reliant on government handouts rather than striving for success through their own efforts.

True compassion is not about giving people what they want; it is about giving them the tools to succeed on their own. This is the fundamental flaw of the welfare state: it assumes that individuals are incapable of achieving success on their own and that they need the government to provide for them. In doing so, it creates a self-fulfilling prophecy. The more the government provides, the more dependent people become, and the less they are able to succeed on their own.

The infrastructure state, by contrast, embodies true compassion. It does not hand out temporary relief – it builds the conditions for long-term success. By investing in infrastructure, the government creates the environment in which individuals can rise above their circumstances and achieve success through their own efforts. It empowers people to take control of their own lives, rather than trapping them in a cycle of dependency.

The Path to Long-Term Prosperity

The welfare state and the infrastructure state represent two fundamentally different visions of society. The welfare state, with its focus on redistribution, creates a culture of dependency, entitlement, and mediocrity. It punishes the productive and rewards the non-productive, leading to long-term economic stagnation and social decay. The infrastructure state, by contrast, creates the conditions for individual success, economic growth, and innovation. It empowers individuals to achieve their full potential through hard work, creativity, and entrepreneurship.

In the short term, welfare may provide relief, but in the long term, it undermines the values and principles that drive human progress. The infrastructure state, by investing in the future, builds the foundation for sustained prosperity and opportunity. The choice between these two models is not just a matter of policy – it is a matter of philosophy. It is a choice between dependency and opportunity, between stagnation and growth, between mediocrity and excellence.

Wealth is not redistribution – it is creation

Wealth is Not Redistribution – It Is Creation

Wealth is not something to be parceled out like rations from a common stockpile. It is not a static quantity that simply exists for governments to distribute at their discretion. Wealth must be created through the productive efforts of individuals. To believe otherwise is to embrace a dangerous fallacy: that the fruits of labor can be claimed by those who did not sow the seeds, that wealth is something to be shared by all regardless of contribution.

In truth, wealth is born from the minds of creators – those who dare to innovate, to think, to produce. The great fortunes of the world were not made by those waiting for a handout, but by men and women who understood the value of their own abilities and used them to bring new products, technologies, and ideas into existence. This process of creation is inherently individual. It is the result of rational thought, purposeful action, and personal effort. It is not something that can be mandated by a collective or coerced into being by force.

To speak of redistributing wealth is to misunderstand its very nature. When governments seize the earnings of the productive to give to the unproductive, they are not creating anything; they are merely moving wealth around, like rearranging furniture in a house, never increasing the value of what is there. Such redistribution stifles the very engine of prosperity by punishing those who create and rewarding those who do not. It removes the incentive to innovate, to risk, to achieve. It tells the producers of the world that their efforts are not their own, that their success belongs to others, that the highest moral duty is not to themselves but to a collective that neither earned nor deserves their gains.

This is the essence of wealth creation: it is the process by which individuals use their reason and their effort to produce value. It is not a pie that can be cut into equal slices, nor is it a well that runs dry when tapped. Wealth, when created, expands. It generates opportunity, spurs innovation, and lifts entire societies. But this process only occurs when individuals are free to keep the fruits of their labor, to act in their rational self-interest, and to reap the rewards of their ingenuity.

Redistribution, on the other hand, is a philosophy of stagnation. It assumes that there is no more to gain, that the world is limited to what already exists. It is a zero-sum game, where one person’s gain must be another’s loss. But this is a denial of reality. The wealth of the world has grown because individuals have created it, not because it was handed to them. The moment the creators are punished for their success and forced to sacrifice their efforts for the unearned, the process of wealth creation halts. The society that embraces redistribution over production is one that will inevitably collapse under its own weight, as fewer and fewer are willing to create for the sake of others.

Wealth is creation. It is the result of human beings exercising their minds, their skills, and their ambition. It is the lifeblood of progress, and it can only thrive in an environment where the individual is free to pursue his or her own happiness and success, without being shackled by the demands of those who do not share that ambition.

The HODL Mentality: A False Promise of Wealth Through Inaction

The mentality of “HODL” that permeates the BTC community is the embodiment of a fundamental misunderstanding of what wealth truly is and how it is created. To simply hold onto an asset, waiting passively for its value to increase without contributing anything of productive value, is not a strategy for creating wealth. It is a form of speculative redistribution: a hope that by doing nothing, one can eventually claim a share of wealth that others have earned through their efforts. This mentality is not only economically unsound, but it is morally hollow, as it defies the very principles of wealth creation.

Wealth, in its truest sense, is the product of active creation – of innovation, labor, and the application of reason to transform raw materials into something of greater value. It is earned through the process of bringing new goods, services, and ideas into existence, solving real-world problems, and improving the quality of life for others. This is what the creators of wealth do: they add value where none existed before. They generate new wealth by engaging in productive work, taking calculated risks, and constantly pushing the boundaries of what is possible.

The HODL mentality, by contrast, is based on the misguided belief that simply holding an asset like BTC will lead to inevitable wealth accumulation. But wealth does not grow out of thin air. It cannot be created through inaction, nor can it be sustained by the mere expectation that others will continue to value the asset for no reason other than speculation. In essence, the HODL strategy relies on the redistribution of wealth rather than the creation of it. Its adherents are waiting for others to buy in at a higher price, hoping that the value of their holdings will increase not because they have contributed anything of substance to the economy, but because they have managed to hold on longer than others.

This is not wealth creation; it is wealth transfer. Those who “HODL” are betting on the efforts of others (on the innovation and productivity of real wealth creators) to generate value that they can later cash in on. They are not building anything, improving anything, or solving any problems. They are merely sitting idle, expecting to profit from the labor and risk-taking of those who are actually engaged in the business of wealth creation. In this sense, the HODL mentality is no different from any other form of speculative investment that relies on the greater fool theory: the belief that one can profit by selling an overvalued asset to someone even more hopeful and uninformed.

The irony of the HODL mentality is that it celebrates the antithesis of what BTC and decentralized systems were purported to stand for; economic freedom, innovation, and the empowerment of individuals to take control of their own financial futures. Instead, HODLers have reduced BTC to a static instrument of speculation, divorced from the productive economy and existing solely as a vehicle for potential future redistribution. In the long run, this mentality is unsustainable, as true wealth is not created by sitting on the sidelines, but by participating in the active process of producing value.

The consequence of this thinking is clear: a system built on speculation and hoarding will eventually falter when no new wealth is being generated to sustain its growth. The value of any asset, including BTC, is not derived from mere scarcity or the number of holders clinging to it in hopes of future profit. Its value, like any other economic good, is determined by its utility, its ability to solve real-world problems, and its contribution to the productive economy. Without these foundations, the HODL strategy is nothing more than a gamble – an unearned hope that value will appear out of nowhere.

True wealth creation demands action. It requires that individuals engage in productive activities, whether through innovation, investment in infrastructure, or the creation of new technologies and services. Wealth is built when individuals work to transform the world around them, solving problems and creating opportunities. HODLers, by contrast, are content to sit back and wait, hoping that others will do the work for them. But wealth does not flow to those who wait – it flows to those who create.

The Fallacy of Redistribution and the Truth of Wealth Creation

Wealth is not, and has never been, something that can be redistributed without consequence. Whether it is the false promises of a welfare state or the passive, speculative mentality of HODLers in the BTC community, the idea that wealth can be sustained or grown without active creation is fundamentally flawed. Both models, in their own ways, rest on the dangerous premise that wealth is a static resource: a pie to be sliced up and handed out, rather than something to be produced through effort, innovation, and productivity.

The welfare state, with its focus on redistribution, traps people in a cycle of dependency. It erodes the very qualities that drive human progress: initiative, responsibility, and the desire to achieve. Rather than lifting individuals up, it shackles them to a system where they wait for others to provide. It is a system that rewards stagnation, punishes success, and ultimately weakens both individuals and the society they live in.

Likewise, the HODL mentality within the BTC community embodies a similarly flawed approach. By glorifying inaction, it falsely promises wealth to those who simply hold on long enough. But wealth does not come from doing nothing. Holding an asset in the hope that its value will rise without any productive contribution is not wealth creation; it is speculative redistribution. The HODLer waits for others to generate real value in the world, banking on the hope that they can reap rewards without ever contributing anything tangible.

In contrast, true wealth comes from creation. It is born from the minds and efforts of individuals who take action, solve problems, and innovate. The infrastructure-focused state, for example, understands this dynamic. By investing in roads, bridges, energy grids, and digital networks, it fosters a culture of opportunity and productivity. These investments lay the groundwork for generations of prosperity, compounding over time and multiplying the opportunities for future creators. In such a system, wealth is not merely moved around; it is expanded. Every productive action adds value to the economy, creating more opportunities for others to do the same.

At its core, the truth about wealth is simple: it is the result of human beings exercising their reason, ambition, and abilities to create something new. Whether through entrepreneurship, technological innovation, or infrastructure investment, wealth is generated by individuals who see opportunities where others see obstacles, and who are willing to work to make those opportunities real. It is a dynamic, ever-growing process that cannot be sustained by inaction or entitlement.

The philosophies of welfare and HODL both fail because they reject this fundamental truth. They promise reward without effort, gain without risk, and wealth without creation. But no society can thrive on redistribution alone. It is only through the continuous process of creation (of building, innovating, and producing) that real wealth can be generated and sustained. This is not just an economic reality; it is a moral one. Human beings are meant to create, not to wait for others to do the work for them.

The difference between these two paths is stark: one leads to stagnation, mediocrity, and decline, while the other leads to growth, opportunity, and progress. In the long run, only those who embrace the principles of wealth creation- through action, innovation, and productivity – will build the future. Those who sit idly by, waiting for others to carry the burden, will inevitably be left behind. Wealth belongs to those who earn it. It is not something to be redistributed; it is something to be created.

Source: